|

|

Step 1:

Site Search |

||

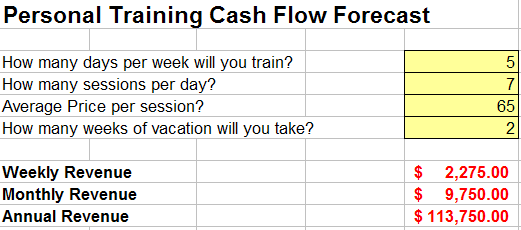

Personal Training Financial Planning BudgetDeveloping your financial planning budget and budget forecasting is a critical step toward launching your personal training business. If you make a mistake on this step, it can cause huge amounts of pain later. We have created a Two year Budget and Cash Flow Projections spreadsheet which you can get for free in our Personal Trainer Starter Kit or you can get a full blown 28 page professional Business Plan using our Business Plan Generator. Section 1: Revenue ProjectionsThe first part of the financial planning budget deals with revenue projections. Simply input the days per week that you will train, the number of sessions per day, and the average price for sessions. The spreadsheet will translate those numbers into weekly, monthly and annual income projections. Modify the numbers until you feel you have the right mix. Remember, be conservative. Of course you can make a lot of money working seven days per week...but will you survive?

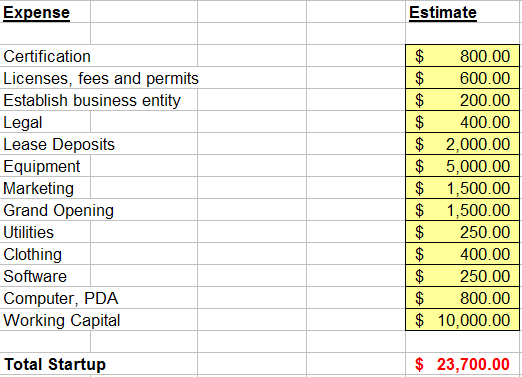

Section 2: Startup CostsPart 2 of the financial planning budget deals with startup costs or one-time costs. Whenever you start a business there are costs involved with just starting. These costs need to be recouped over time. Fortunately, they usually only happen once.

The costs included in our spreadsheet are just estimates. You will need to modify them to tailor to your particular situation. For example, you may choose to not have a physical location. You can save a lot of money by training outdoors, in client's homes and at gyms.

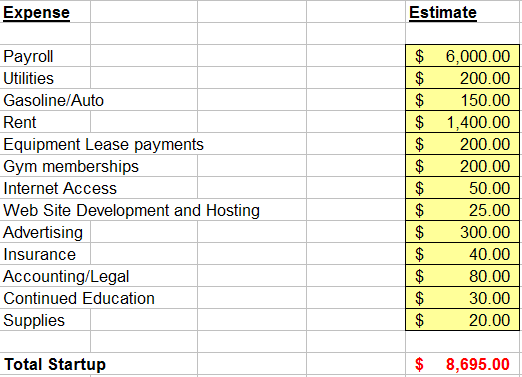

Section 3: Budget Forecasting ExpensesThese are your monthly expenses. Be very careful when estimating these monthly numbers because small changes will have a large impact on your annual financial planning budget.

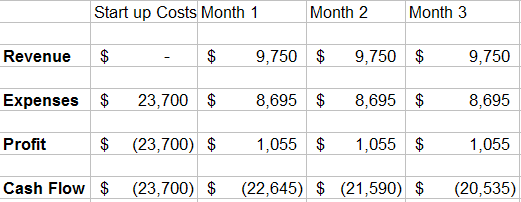

Section 4: Financial Planning Budget and Cash FlowThis section is where all the data comes together to give you the financial planning budget and cash flow projections for 24 months. You can determine when your business will break even by seeing in which month the cash flow becomes positive. But remember, even though it may take along time to recoup your startup investment, you are earning a salary and doing what you love the whole time.

Remember that you can download this spreadsheet as part of our free Personal Trainer Starter kit.

Next Page: Logo Design and Business Cards

Next Page: Logo Design and Business Cards

Navigation Guide: Home Page / Step 4 Index / Financial Planning Budget

|

||